THE DOLLAR IS DOOMED

Intrinsic Value vs. Fiat Currency

Can you spend hard assets like paper money?

From Martin Armstrong:

"Once public confidence is destroyed, respect for government indeed collapses;

hoarding of wealth takes place and a refusal to accept the currency on faith."

"The threat we face is that the entire system must be looked at as a whole.

Seeing California broke is the tip of the iceberg. As this contagion spreads from

one state to the next ... because we have perhaps $50 to $100 trillions

of unfunded promises not just Federally with Social Security, but in pensions

to government workers."

From George Bernard Shaw in 1928

(when gold was $20.67/oz):

"If you have to choose between trusting the natural

stability of gold and the natural stability

and intelligence of the members of the government,

with all due respect to those gentlemen,

I advise you, as long as

the capitalist system lasts, vote for gold."

From the "Charleston Voice" 4/26/2006:

"By the end of the Weimar inflation nearly all household income went for food just to live...Farmers

fared best in the survivor class being able to barter their products (we'll barter with our silver

and gold coins).

"The Weimar inflation took root in 1914 with WWI. Not wanting to raise taxes,

the German government printed banknotes. Sound familiar? It ran about nine years

until total worthlessness beset the currency. But, with today's digital money and computer ledger entries, it's difficult to project how much time

we have left to protect ourselves. The Federal Reserve (it's neither Federal and has no reserves) is not

hindered by cumbersome printing and ink. It could be upon us in the blink-of-an-eye.

The US Dollar could become worthless instantaneously - overnight.

You will have no time to react."

1932 $10 Gold Indian.

Here is a nice example of a collectible coin made from Gold.

I understand that the following story is true.

There was a businessman who traveled to Germany often in the early 1900's.

He would stay in the same hotel, and eat at the restaurant that was in that hotel.

One day, he said to

his favorite waiter, "I am concerned about what will likely happen

to your country soon.

Take this $10 Gold coin, as a gift, and KEEP IT. When things get really bad,

I want you to use it to buy this restaurant!"

A few years passed (WWI came and went,) and he returned to Germany. As before,

he went

to the same hotel, the same restaurant, and saw his favorite waiter,

still waiting tables.

He said to his friend, "I am disappointed. I didn't want you to have

to wait tables all your life. Didn't you remember my advice?"

The waiter said, "I did remember, and thought it was a good idea

to buy this restaurant, but decided to buy the hotel instead."

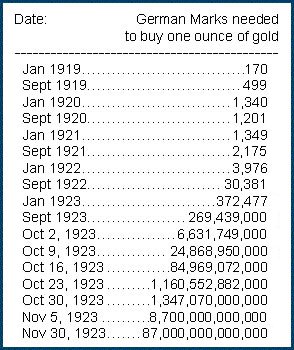

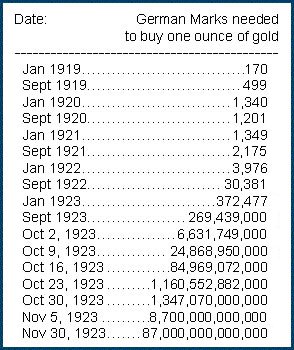

Hyperinflation during the Weimar Republic

___________________________________

Remembering the price of 1 oz. of gold was 20 US Dollars, one can see that,

if this was the US, gold would have risen to over 10 Trillion dollars an ounce in less than 5 years.

I also understand from history that, in the Weimar Republic, workers demanded

to be paid every hour, and their wives would wait outside the factory gates.

The workers would rush to give the money to their wives to go buy food,

because the money would be worthless in such a short time. The 10 Mark note

gave way to the 100 Mark note, then to the 1,000 Mark note, and so on...

This escalated till the 1 Million Mark note gave way to the 10 Million Mark note.

It got so bad that, at one point, just one pound of bread cost 3 billion

German Marks.

THE DOLLAR IS DOOMED:

...and It's Fate Will Be Sealed Later This Month...

Jack Weber - March 2006

The total destruction of the US Dollar is nearer now than at any time in our lives. And, that's kind of like saying that my death is closer than at any time in the past. Both are equally true, because no frail human has ever lived forever and NO unbacked paper currency in the entire history of mankind, has EVER survived. The mortality rate is 100% in both cases. Perhaps you don't wish to think about either case, but you better - in both cases! If you aren't ready to leave your mortal body, we need to talk. If you aren't ready to face the fact that the US Dollar is nearing the end of well over 200 years of its life, you are going to experience some terrible consequences financially - and this newsletter contains many of the reasons why I know the end is near.

The next few paragraphs may bore you, but a little history can help you understand the future. In 1945, our country was the strongest military power, with the strongest economy and with the strongest gold-backed currency that the world had ever known. Because of this, and the fact that the US would redeem our dollars for gold to Central Banks, our leaders were able to convince these banks to establish the US Dollar as the reserve currency of the world. And, since the US had more gold than nearly all the gold held by all these Central Banks combined, it seemed that this was a sure thing, so they formed to the Bretton Woods Agreement in 1945. But, this "sure thing" only lasted for 26 years, because in 1971, President Nixon announced the default (actually the bankruptcy) of the US Dollar, declaring that those Central Banks could no longer redeem their US Dollars for gold. As you may recall, that was when the price of gold left the launching pad of about $42/oz, rising to $197.50 in late 1974.

This same type of abrupt rise is again staring us in the face - right now!

As it became clearer and clearer that the US would not be able to buy back its dollars for gold, in 1972-73 our government made an iron-clad arrangement with Saudi Arabia to support the power of the House of Saud in exchange for their accepting only US Dollars for their oil, and the rest of OPEC was to follow suit. Therefore, since the entire world had to buy oil from the Arab oil countries, it had good reason to hold dollars as payment for their oil. This was the case because even though those dollars could no longer be exchanged for gold, they could be exchanged for oil. This is the only reason why the US Dollar has been able to maintain its domination of the world currencies and stay in its place as the reserve currency of the world. However, this is about to change - THIS MONTH!!! You may be asking, "How do you know that?"

Read on.

Here's the title of an article published by "LEAP/E2020," on 2/11/2006 -

"The End of the Western World we have known since 1945."

The article is 5 1/2 pages long, and here are the first five paragraphs:

"The Laboratoire European d'Anticipation Politique Europe 2020, LEAP/E2020, now

estimates to over 80%, the probability that the week of March 20-26, 2006 will

be the beginning of the most significant political crisis the world has known

since the Fall of the Iron Curtain in 1989, together with an economic and

financial crisis of a scope comparable with that of 1929. This last week of

March 2006 will be the turning-point of a number of critical developments,

resulting in an acceleration of all the factors leading to a major crisis,

disregard(ing) any American or Israeli military intervention against Iran. In

case such an intervention is conducted, the probability of a major crisis to

start, rises to 100%, according to LEAP/E2020.

"An Alarm based on 2 verifiable events.

"The announcement of this crisis results from the analysis of decisions taken by the two key-actors of the

main on-going international crisis, i.e. the United States and Iran:

o On the one hand there is the Iranian decision of opening the first oil bourse (A stock exchange)

priced in Euros (instead of US Dollars) on March 20th, 2006 in Teheran, available to all

oil producers of the region;

o On the other hand, there is the decision of the American Federal Reserve to stop publishing

M3 figures (the most reliable indicator on the amount of dollars circulating in the world)

from March 23 onward.

"These two decisions constitute altogether the indicators, the causes and the consequences

of the historical transition in progress between the order created after WW II and the new

international equilibrium in gestation since the collapse of the USSR. Their magnitude, as

much as their simultaneity, will catalyze all the tensions, weaknesses and imbalances

accumulated since more than a decade throughout the international system."

Later quotes include:

"This double development will thus head in the same direction,

i.e. a very significant reduction of the importance of the Dollar as the International reserve

currency, and therefore a significant and sustainable weakening of the American currency

...LEAP/E2020 estimates that the American decision to stop publishing M3 (money supply figures)

aims at hiding, as long as possible, the monetization of the US debt."

In other words, our government will simply print enough paper dollars to pay off our country's debts,

and in the process destroy the remaining purchasing power of our dollars. This process will

probably result in a two-tier dollar currency, namely an overseas US dollar, and a

domestic dollar. I wrote an article about this probability about three years ago. And, guess

which one will be worth less?

Near the end of this article, this paragraph leaps off the page:

"LEAP/E2020 anticipates that these two non-official decisions will involve the United States and

the world in a monetary, financial, and soon economic crisis without precedent on a planetary scale.

The monetization of the US debt is indeed a very technical term describing a catastrophically

simple reality: the United States will undertake to not refund their debt, or more exactly

to refund it in "monkey currency." LEAP/E2020 also anticipates that the process will

accelerate at the end of March, in coincidence with the launching of the Iranian Oil Bourse,

which can only precipitate the sales of US Treasury Bonds by their non-American holders."

My reader friend, THIS IS SERIOUS!

Whether you ever buy another gold or silver coin from yours truly or not, PLEASE get your

savings out of US paper currency and other US dollar denominated assets, such as CD's, bonds,

savings accounts, etc!!

In another insightful article "The Proposed Iranian Oil Bourse,"

Dr. Krassimir Petrov states:

"...this represents a much greater threat to the hegemony of the dollar than Saddam's,

because it will allow anyone willing either to buy or to sell oil for Euro's, to be able

to transact on the (Iranian Oil Bourse), thus circumventing the US dollar altogether,

meaning:

1. The Europeans will not have to buy and hold dollars in order to secure

their payment for oil, but would instead pay with their own currencies. The adoption of

the Euro for oil transactions will provide the European currency with a reserve status

that will benefit the Europeans at the expense of the Americans:

2. The Chinese and the Japanese will be especially eager to adopt the new exchange because it will allow them

to drastically lower their enormous dollar reserves and diversify with Euros:

3. The Russians have inherent economic interest in adopting the Euro - the bulk of their trade is with

European countries:

4. The Arab oil-exporting countries will eagerly adopt the Euro as

a means of diversifying against rising mountains of depreciating dollars...At any rate...should

the Iranian Oil Bourse accelerate, the interests that matter - those of Europeans, Chinese,

Japanese, Russians, and Arabs - will eagerly adopt the Euro, thus sealing the fate of the

dollar. Americans cannot allow this to happen, and if necessary, will use a vast array of

strategies to halt or hobble the operation's exchange, by:

1. sabotaging the Exchange;

2. negotiating acceptable terms and limitations;

3. joint U.N. War Resolutions;

4. unilateral nuclear strikes; or

5. unilateral total war

...Whatever the strategic choice...it will precipitate the demise of the dollar...

(the) ultimate accomplishment will be the hyperinflationary destruction of the American currency

and from its ashes will rise the next reserve currency of the world - that barbarous relic - GOLD."

Trust me friend - THE US DOLLAR IS DOOMED!!!!!!!!! That's the dark side. If you think we've seen inflation

in this country in our lifetime (the 3-cent stamp of our childhood is now 42 cents) has been bad,

"you ain't seen nothin' yet." The bright side is that gold is destined to shine more brightly than it ever has!

This quote was taken from an article about gold by one of the top gold fund managers in the business,

John Hathaway. He manages the Tocqueville Gold Fund. Simply put, Hathaway believes "...the bull market in gold

has just begun, but 2006 will contain wild swings in the gold price...and these swings will offer good buy spots

(like I believe we are presently seeing)."

Gold cleared $570 an ounce three weeks ago -- for the first time in over 26 years, and has been as low as $538

in the meantime. Wild price swings are here with more to come. And, continues Mr. Hathaway, "Four digits

no longer seems like a stretch to me...Rather, it would seem that gold would be correctly priced at $1,000,

just to catch up to other commodities like oil, base metals, natural gas, and platinum."

The way Hathaway sees it, "...you can divide a bull market into four phases:

1. The beginning,

2. The end of the beginning,

3. The beginning of the end, and

4. The end.

Right now, we are starting 2. The end of the beginning phase. The 'beginning' phase is now over. In phase 2.,

the market moves higher, but no one really knows why, so the press doesn't really discuss it, and the public

at large doesn't notice. More people are talking about gold these days. Media awareness has increased.

And the attention is attracting new money into gold. These are the hallmarks of the 'end of the beginning' phase.

The big moves are still ahead of us."

As the price advance continues, the reasons for the bull market become more apparent. That will be the third phase,

the beginning of the end. The money on the sidelines turns bullish. Finally, when it's obvious why gold is advancing

and all the fundamental explanations can be summed up in a banner headline in your local newspaper,

you know you've reached the final days of the bull market. In Hathaway's opinion, "...those days are still well ahead

of us, both in terms of time that must elapse and the magnitude of price appreciation."

After reading Hathaway's article, my advice to you is still the same: Hold as much gold (and silver) as you

can possibly afford - especially as you see the deterioration of the US dollar as described in the early part

of this newsletter. But beware, as the gold price rises, so will the volatility. Don't let it shake you out of your position.

In terms of the US Dollar, gold is still dirt cheap - and silver is an even better bargain! I hope you have

enough to survive what's coming, because it won't be pretty! There is hope for those who don't insist upon holding depreciating paper dollar assets.

Excuse me for repeating a paraphrase from Richard Russell, who writes the Dow Theory Letter,

but in case you missed it before, he contends that, "As gold and the Dow Jones Industrial Average met

at the same price in 1980 (850), they will again reach the same level in this gold bull market,

somewhere between 2500 and 3500." This will result in a disaster for those who continue to hold most industrial type

stocks, and will allow those who see the wisdom of his newsletter to survive the difficult times ahead.

I hope you're in the gold group.

Feel free to make copies of this newsletter for anyone you care about.

Jack Weber

_____________________________________________

"We can't solve problems by using the same kind of thinking we used when we created them."

Albert Einstein

_____________________________________________

Thank you for your interest!

|