THE PLOT THICKENS

Do you have some as a hedge against inflation?

The U.S. Constitution dictates that "The Congress shall have Power…" "To coin Money, regulate the Value thereof," (Article I, Sec. 8) and "No State shall…" "make any Thing but gold and silver Coin a Tender in Payment of Debts;" (Article I, Sec. 10.)

1922 Peace Silver Dollar.

Here is another example of a collectible coin made of 90% Silver.

The Peace Silver Dollar was issued from 1921 to 1935.

The Morgan Silver Dollar was issued from 1878 to 1921.

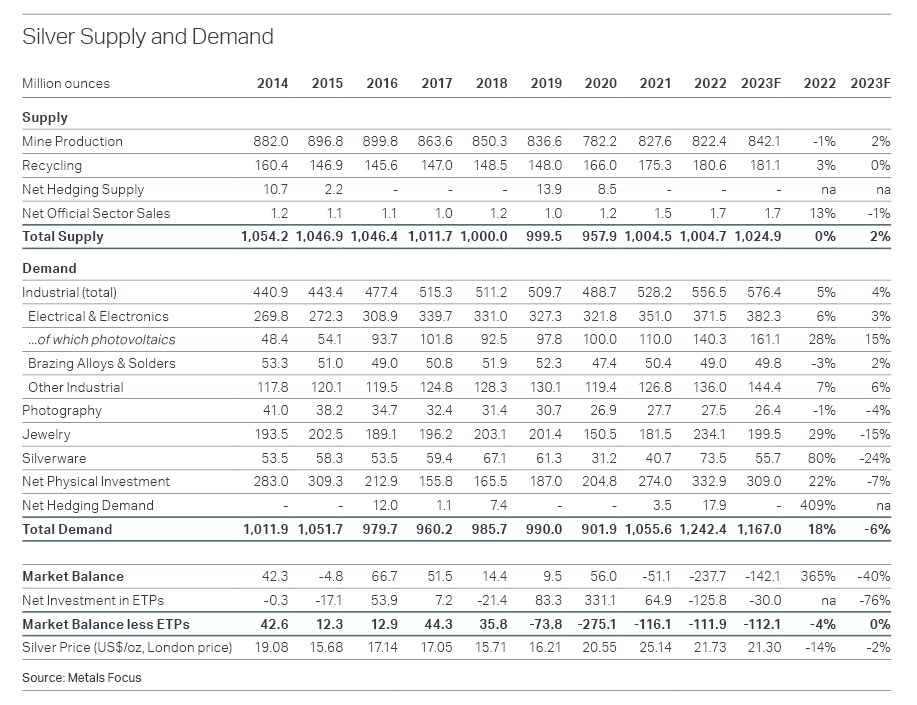

Here is recent history on Silver Prices.

Silver Prices

________________________________

Silver was once $50/oz.

A few years ago, it was barely more than $4/oz.

It's getting VERY close to $50, again!

THE PLOT THICKENS

The second shoe drops!

You'll recall (I hope) that last month I sent you my newsletter entitled: "WHY?" My question was in reference to the suddenly announced "withdrawal" of NM Rothschild as a member of the London Bullion Market Association (LMBA), sometimes called the London Gold Pool. It still remains a total mystery as to why no one else that I read (and I do read extensively), including James Sincliar (whom I quoted extensively) has made any in-depth references to this startling, and I believe extremely significant move by NM Rothschild.

And now (6/1) we have fuel added to the "fire," namely a second giant in the precious metals market has made a similar announcement through Reuters: "AIG International Limited no longer an LBMA market maker in gold, silver." NO EXPLANATION OF ANY KIND WAS GIVEN!

What is going on!? Are the "rats" abandoning a sinking ship?

There is no question in my mind that something very significant is going to happen in the precious metals (especially gold) in the very near future. You may recall that in my "WHY?" letter, I quoted Jim Sinclair as saying: "Gold to be Remonitized: First by the 'Malaysian Dinar' in June of 2003 followed by the 'US Dollar' in June of 2004. The Gold Price Will Continue to Float." At that time, I'm quite certain that Mr. Sinclair had no inkling that NM Rothschild would ever bow out of the London Gold Pool, which it founded." I'm equally confident that Jim had no idea that AIG would also bow out. He continued: "June 2004 is when the Bush re-election campaign will make its push for the November elections…You must see the 18-month (at that time, January '03 to June '04) time line that the economic stimulation tax plan has for those that will fund the 2004 Bush Campaign." Was the Rothschild, and now the AIG withdrawal done in anticipation of something really significant which is yet to occur between June and November of this year? I have no doubt!

Is the real reason that the Middle & Far East countries about to terminate their acceptance of the paper dollar? Jim Sinclair made such an intimation a year and a half ago: "Gold is headed back into the system by a modernized and revitalized Federal Reserve Gold Certificate Ratio tied to the expansion of M3 (the broad monetary aggregate figure). The value of Treasury gold (if there is any) on the day of enactment will be considered to be that value which is required to have (for) that size M3. From that point forward, more gold, (and) or a higher price for gold will be required in order to expand the broad based monetary aggregate (M3) beyond a modest percentage. The Treasury could simply benefit from a higher price or could buy gold in the open market to effect a higher price (does such an increase in our central bank buying of gold lead you to believe that the gold price would go down?) should the need arise to expand beyond the present level in M3, beyond a predetermined expansion of (say) 3% per year."

And, as I intimated in my "WHY?" newsletter, the "smoke" that has been emanating from the gold derivatives market for the past several years may be the key to these bizarre announcements. According to the "Q1 04 Hedge Book" it states that the total gold hedges have been reduced from 102 million ounces to a mere 68 million ounces. Well, if my calculator is correct, this is still over $26,000,000,000 worth of gold that has been sold by producers, etc., and if delivery were required in any short time frame, it simply isn't available! Do these London gold bullion market makers see something gigantic on the horizon (such as defaults on gold derivative contracts) that has gotten them to take such drastic steps as to withdraw from the LBMA? As I said in "WHY?": It's my opinion that they are expecting counter-party derivatives failures in the gold market in the very near future, and they (NM Rothschild) don't wish to be a victim of the ensuing pandemonium.

Another item I mentioned in "WHY?" was "…the US$ index had dropped from it's 2002 high of about 124 to a recent low of 85, and is currently about 91 with major resistance at 92. To stop the downward spiral of the US$, something must be done to stabilize it and regain some semblance of long-term faith in that paper asset, or it could trigger a collapse of all paper currencies. A "Sincliar" described "Gold Cover Clause" would fill the bill -- to say nothing of stabilizing all currencies, especially of gold-holding nations." Meanwhile, the US$ index did slightly exceed 92 and is currently back down to 88.97 on its way to…oblivion?

I know is that I'm very glad we hold extensive positions in gold and silver coins and stocks. If you don't, I suggest that now that June first has come and gone, this would be an excellent time for you to do likewise. I truly believe that the time is now very short until an explosion (or implosion) in the financial world will hit. I sincerely trust you have enough gold to weather the extremely interesting turbulence just ahead.

This closing thought from my "WHY?" newsletter: "I leave you with a recent comment by renowned author of The Dow Theory Letter, Richard Russell, who said this about the recent dip in the gold price: 'Personally, I'm going to hold my gold. Holding the metal doesn't worry me. I still have gold that I've carried from the '70s. Gold is the only real money. I don't care, inflation, deflation, boom or bust -- gold is money, and I can't say that about any paper currency. I'm holding all my gold. In the long run, I believe both gold and gold shares will win. Personally, I've decided that I'm going to sit with my gold-share position. But if I do anything additional in the gold area, it will be to buy more coins.'" Do you have enough coins?

Jack Weber

This article is not copyrighted. Feel free to send a copy to anyone about whom you are concerned._____________________________________________

Thank you for your interest!